【 微信扫码咨询 】

【 微信扫码咨询 】

Investment points

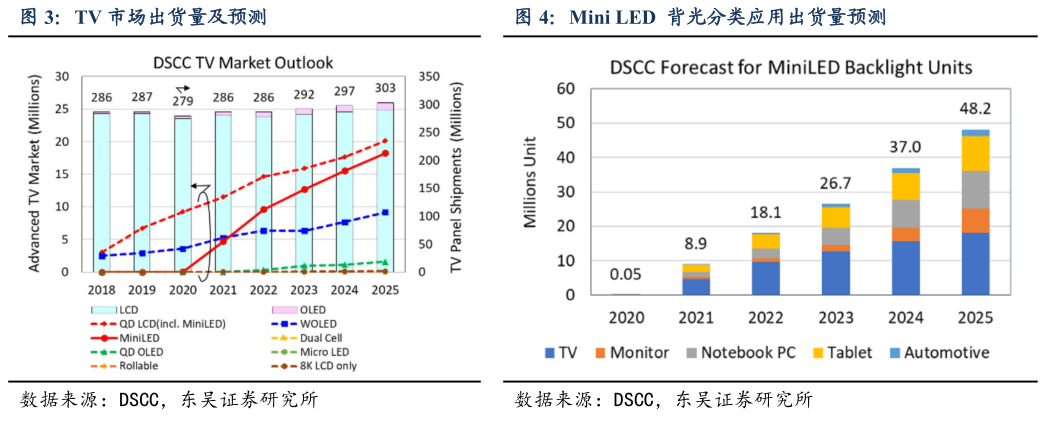

Mini LED backlight TV shipments are expected to reach 8.9 million units in 2021: DSCC released the latest report. As Samsung and Chinese brands launch LCD TVs with Mini LED backlights, it is expected that Mini LED technology will develop rapidly in 2021 , Mini LED backlight shipments will increase from 500,000 units in 2020 to 8.9 million units in 2021. Mini LED growth is not limited to the TV field. As the supply chain matures and manufacturing costs decrease, DSCC's analysis shows that the three market segments with the largest sales of Mini LED backlight products will be TVs, laptops and tablets. DSCC predicts that by 2025, total shipments will exceed 48 million units.

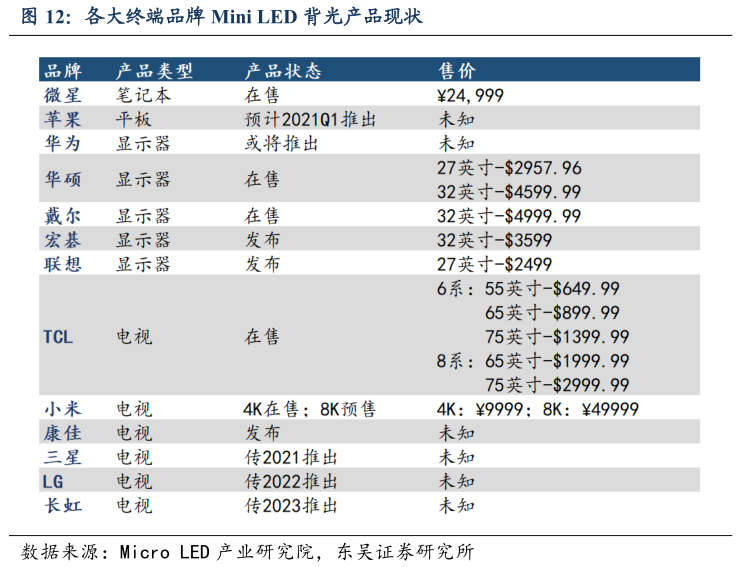

Backlight is the main application of Mini LED, and cost control is the focus of development: Based on terminal application scenarios, the application fields of Mini LED can be divided into two scenarios, direct display and backlight, as direct display applications. Because of the high price of direct display, the advantage is not obvious in the current market dominated by commercial display customers, so as a backlight source is the main application scenario of Mini LED. In the high-end display field, the cost of Mini LED backlight is 60%-80% of the same size OLED. At the same time, Mini LED backlight relies on the traditional display industry chain, and only needs to upgrade existing equipment, so as to achieve high contrast at low cost, help LCD products meet the challenges from OLED and increase their added value. You need to pay too much cost to get higher profits, so major terminal manufacturers have deployed or launched Mini LED related products one after another.

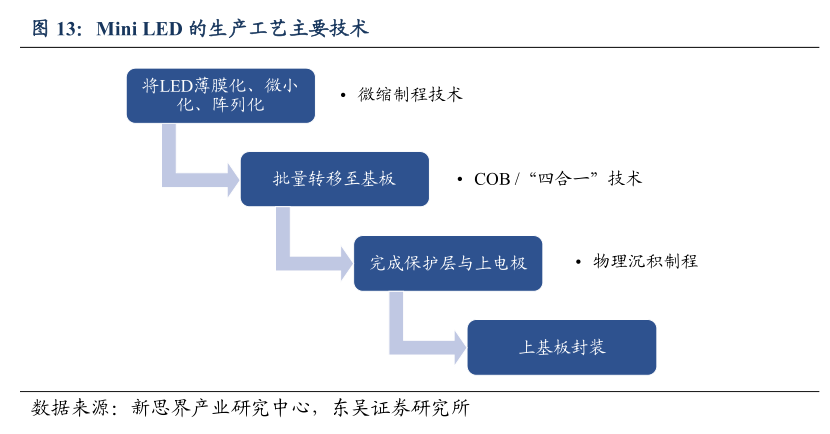

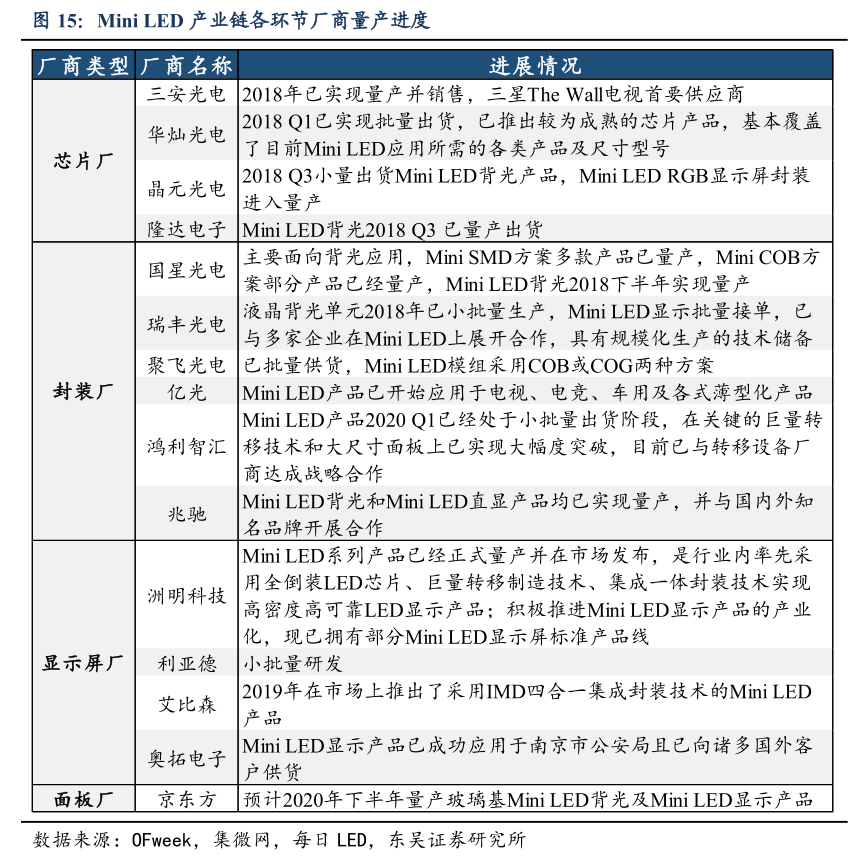

Mini LED injects new vitality into the industry chain, and each link is actively deployed: The Mini LED industry chain includes equipment, chips, packaging, backlight modules, panels, and terminal brand factories. In the upstream chip link, Sanan Optoelectronics, Zhaochi Co., Ltd., and HC Semitek are actively expanding Mini LED production capacity. Mini LED chips are mature in technology and high in value, and are about to usher in large-scale mass production. Packaging companies such as Midstream Ruifeng Optoelectronics and National Star Optoelectronics have mass-produced Mini LED products and will greatly expand their production. Downstream panel manufacturers BOE, China Star Optoelectronics, Innolux, AUO and other panel manufacturers have launched differentiated Mini LED solutions for different markets. Terminal manufacturer TCL released the world's first active Mini-LED 142-inch display based on IGZO glass substrate Manufacturers such as Xiaomi and Konka have released Mini LED backlit TVs. Samsung, LG, Changhong, etc. are expected to launch in 2021, and Apple is also expected to launch Mini LED backlit iPad products in 2021.

Suggested attention: It is recommended to pay attention to chip manufacturers Sanan Optoelectronics and Zhaochi Co., Ltd., which are actively deploying Mini LEDs, packaging manufacturers Ruifeng Optoelectronics, National Star Optoelectronics, and downstream applications of TCL technology.

Risk warning: exchange rate fluctuation risk; macroeconomic fluctuation risk; market development is not as expected.

This week’s view: Mini LED backlight is coming soon, the industry’s new blue ocean opens

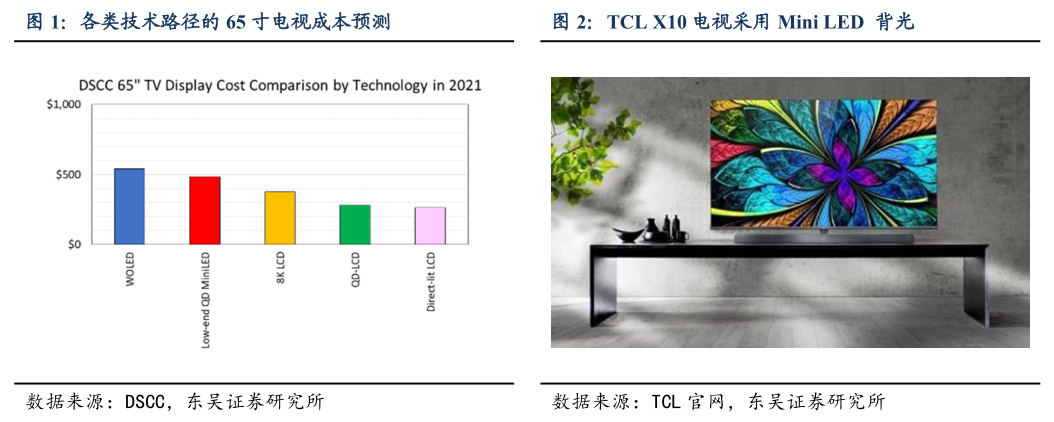

1.1. Mini LED backlight applications are about to start. The total shipments in 2025 are expected to exceed 48 million DSCCs. The latest report is released. As Samsung and Chinese brands launch LCD TVs with Mini LED backlights, it is expected that Mini LED technology will be launched in 2021. The year will see rapid development, and Mini LED backlight shipments will increase from 500,000 units in 2020 to 8.9 million units in 2021. In the high-end TV field, compared to OLED TVs (WOLED and inkjet OLED), Mini LED-backlit LCD TVs have a higher cost advantage.

Mini LED growth is not limited to the TV field. Apple suppliers are said to have begun producing Mini LED backlights for the new iPad Pro to be released in 2021. As the supply chain matures and manufacturing costs decrease, DSCC's analysis shows that the three market segments with the largest sales of Mini LED backlight products will be TVs, laptops and tablets. DSCC predicts that by 2025, total shipments will exceed 48 million units.

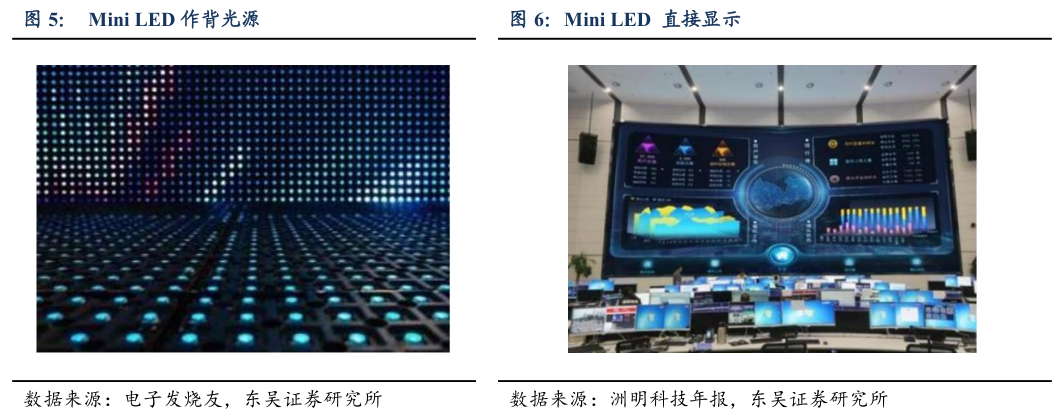

1.2. Backlight is the main application of Mini LED, and cost control is the focus of development. Mini LED, as a new technology with broad market prospects, has the advantages of "thin film, miniaturization, and array", and will gradually be introduced into industrial applications. Based on terminal application scenarios, Mini LED applications can be divided into two scenarios: direct display and backlight.

As far as direct display applications are concerned, compared with small-pitch LEDs, Mini LEDs achieve higher pixel density through a smaller dot pitch, and the use of flip-chip COB or IMD packaging technology can further improve the problem of picture granulation. On the other hand, indoor display products do not require high brightness. Mini LED can improve the high brightness problem of small-pitch LEDs and improve the grayscale display effect under low brightness. However, Mini LEDs are expensive for direct display, and their advantages are not obvious in the current market dominated by commercial display customers. Therefore, backlighting is the main application scenario for Mini LEDs.

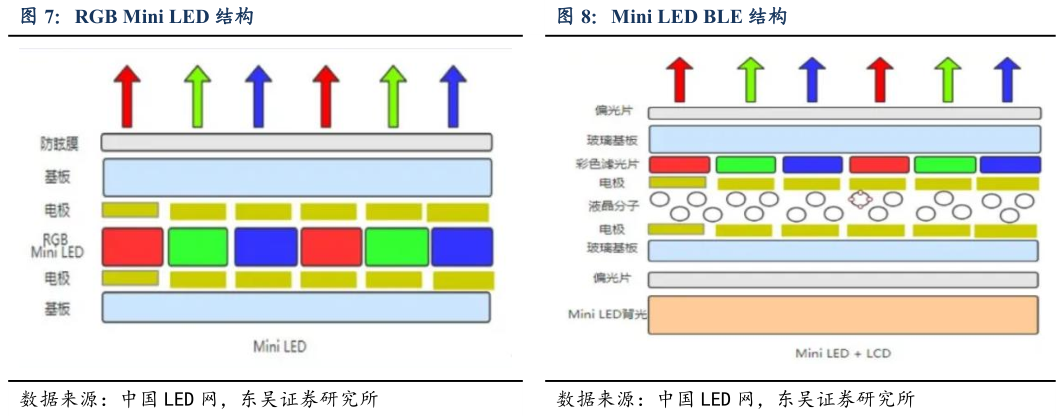

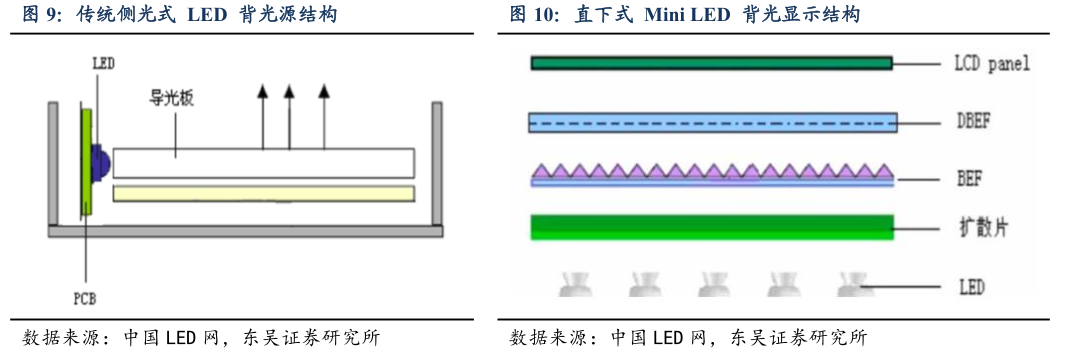

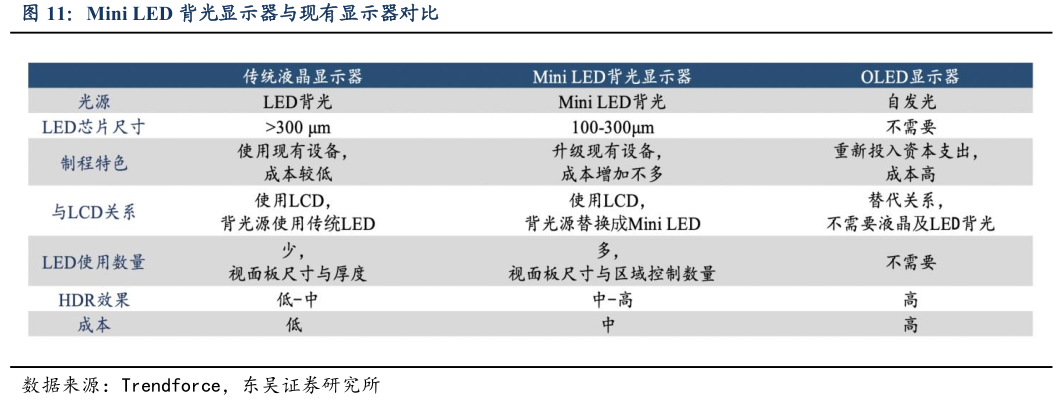

Backlight refers to a form of lighting that uses LEDs as the light source to illuminate from the side or the back to the back of the display device. It is often used in LCD displays. Its role is to provide light sources for transmissive display elements, such as computer liquid crystal displays. And the mobile phone display provides the light source. When used as a backlight source, Mini LED can achieve local dimming, which can bring finer HDR (bright and dark) partitions to the LCD. Mini LED adopts a direct-down design, replacing dozens of LED lamp beads on the side of the traditional backlight screen with tens of thousands or more lamp beads at the bottom. The large number of densely packed areas realizes dimming in a smaller area. A high dynamic range HDR screen effect. The design is better than OLED in terms of color rendering, color contrast, and energy saving. At the same time, because its design can be matched with a flexible substrate, it can cooperate with the curved surface of LCD and can also achieve a curved display similar to OLED while ensuring image quality.

Unlike the smaller MicroLED, the size of the Mini LED is very suitable for integration into an LCD with local dimming function. By increasing the number of local dimming zones, MiniLED-backlit LCD panels can achieve a contrast ratio of more than 1,000,000:1 and higher resolution without sacrificing brightness. Therefore, MiniLED backlight LCD panels can meet HDR (High Dynamic Range) specifications. At the same time, the thickness of the panel is also reduced compared with a display using a conventional full-array local dimming. By combining MiniLED backlight with quantum dot enhancement film (QDEF), the resulting LCD display has a wide color gamut covering more than 99% of the DCI-P3 standard. With its excellent performance, MiniLED backlight displays can directly compete with OLED panels.

In the high-end display field, the cost of Mini LED backlight is 60%-80% of the same size OLED. At the same time, MiniLED backlighting relies on the traditional display industry chain, and only needs to upgrade the existing equipment, so as to achieve high contrast at low cost, help LCD products to meet the challenges from OLED and increase its added value, manufacturers do not need Paying too much cost can get higher profits, so major terminal manufacturers have deployed or launched Mini LED related products one after another.

However, compared with ordinary LCD displays, the balance of cost and performance is critical to the market acceptability of Mini LED backlights. Calculated based on the number of chips used, the cost of Mini LED backlight LCD panels is estimated to be 2.2-3 times the cost of ordinary LED backlight products with the same size and resolution. Take a 65-inch TV as an example. At present, the cost of the lamp beads used in the Mini LED backlight is about 2,000 yuan. The cost of the Mini LED backlight module is more than half of the entire display, LCD accounts for 15%-20%, and the printing part accounts for 15%. -20%. The backplane is different from the traditional backlight. It is a large 60-inch board, so the PCB accounts for 50%-60%, and the IC part accounts for about 15% of the cost. The price of a 65-inch ultra-high-definition direct LED backlight LCD module with quantum dot enhancement film is about $600; if Mini LED backlight is used, the module will require 16,000 chips and the cost will rise to $700; if it is to improve display performance The use of 40,000 Mini LED chips in the backlight may further increase the cost to 1,200 US dollars. It can be seen that there are still many technologies that need to be upgraded and improved in related links, which also brings business opportunities for new materials and new equipment.

1.3. Mini LED Industry Chain Analysis

The production process of Mini LED first needs to thin, miniaturize, and array the LEDs through miniaturization process technology to make the size only about tens of microns, and then use COB or "four-in-one" technology to transfer Mini LEDs in batches to rigid , On the flexible transparent or opaque substrate, the protective layer and the upper electrode are completed by the physical deposition process, and finally the upper substrate is packaged to complete the Mini LED display with simple structure.

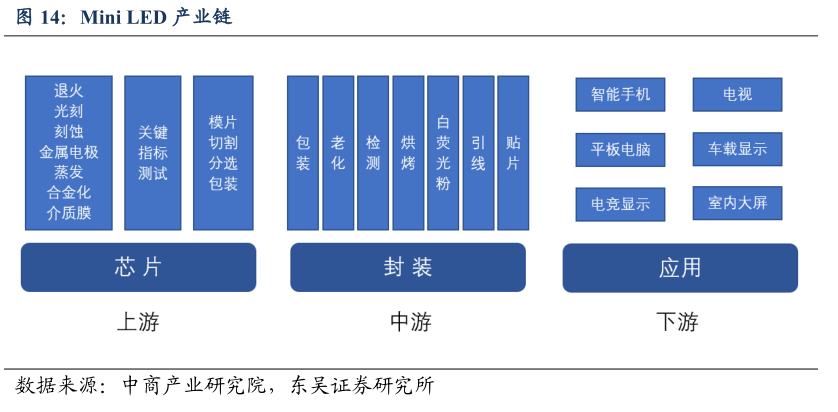

Therefore, the Mini LED industry chain is divided into upstream chips, midstream packaging and downstream applications. The chip manufacturing link is to prepare epitaxial wafers into luminescent particles through a series of semiconductor processes, and pass key index tests, and then perform grinding, cutting, sorting and packaging. Midstream packaging refers to the link connecting the outer leads to the chip electrodes to form a Mini LED device. The main function of the package is to protect the chip and improve the light extraction efficiency. The downstream is mainly used in mobile phones, TVs, tablets, car displays, etc.

Although the development of Mini LED backlight is currently facing some obstacles and limiting factors, as the efficiency of packaging equipment increases, the cost of Mini LED applications will decrease, and the penetration rate of Mini LED backlight will continue to increase. In addition, when the final product of Mini LED backlight is mature in the future, it will gradually be unified into 1-2 types of Mini LED backlight. Various manufacturers will reduce costs and increase efficiency in a targeted manner, making Mini LED display products popular and popular by more users. accept.

1.4. Sorting out listed companies in the Mini LED industry

At present, with the gradual maturity of core technology and the decline in cost, Mini LED is already in the air. We are optimistic about the companies that have in-depth deployment of Mini LED and are the first to develop the layout in the Micro LED industry chain, as well as companies with technological potential in each link, we recommend focusing on:

1. Sanan Optoelectronics: The company is mainly engaged in the research and development, production and sales of panchromatic ultra-high brightness LED epitaxial wafers, chips, III-V compound semiconductor materials, microwave communication integrated circuits and power devices, optical communication components, etc. The performance index is at the international advanced level. The company has already supplied Samsung Mini/Micro LED products in batches, established a joint laboratory with TCL Huaxing, and accelerated the construction of Hubei Mini/Micro projects. In addition, the company's MiniLED chips are also expected to be supplied to major international customers in batches for tablets and laptops. .

2. National Star Optoelectronics: Specializing in R&D, production and sales of LED and LED application products, it is a key high-tech enterprise of the National Torch Program. The company has won many honorary titles such as the famous domestic LED brand, the best packaging company brand, the TOP10 international competitiveness of Chinese LED companies, and the best-performing LED listed company. The company fully implements the international quality system and environmental system, and has passed the six system certifications of ISO9001, ISO14001, TS16949, OHSAS18001, ISO/IEC17025, and measurement system, and has won numerous honorary titles. In the future, benefiting from the increase in Mini LED penetration rate and the price reduction of upstream chips, the company's financial indicators will continue to improve.

3. Ruifeng Optoelectronics: Mainly engaged in LED packaging and providing related solutions. It is a leader in the domestic LED packaging field. It has three major businesses in lighting LED devices and components, high-end backlight LED devices and components, and display LED devices and components. Has extensive market influence. Its products are widely used in LCD TVs, computers and mobile phones, urban lighting, automobiles, medical health, security intelligent control and other fields. It is a leading enterprise in the domestic LED packaging field. According to the 2018 semi-annual report, the company invested RMB 29,508,500 in R&D during the reporting period, applied for 379 patents, and authorized 281 patents.

4. Fuman Electronics: Mainly engaged in the design, development, packaging, testing and sales of high-performance analog and digital-analog hybrid integrated circuits. It is a national high-tech enterprise specializing in integrated circuit design. The company’s main products include power management chips, LED control and drive chips, MOSFET chips and other chips.

In the application market of key chip products, the company has a high reputation. Relying on the company's advantages in technology research and development, business model, fast service and talent reserves, the company has become an excellent enterprise in the subdivisions of power management chips, LED control and driver chips in the integrated circuit industry.

5. Shengbang Co., Ltd.: It is the leader of the local analog chip that has accumulated a lot of accumulation and is deeply engaged in the development of analog chips, and has a rich product line of signal chain and power management. The company’s main products are high-performance analog chips, covering two major areas of signal chain and power management. Currently, there are more than 1,200 models available for sale in 16 categories, which can be widely used in communications, consumer electronics, industrial control, medical instruments, and automobiles. Electronics and many other fields. Excellent product competitiveness and outstanding growth momentum in the future.

6. TCL Technology: TCL Group is the world's third largest TV manufacturer, second only to South Korea's Samsung and LG, with a global sales network, and its net profit margin has continued to increase in the past three years. With the help of its parent company to produce TV panels, the company has global core competitiveness. It has intensively cultivated in many core countries in the developed regions of North America, Europe, Australia, and the developing regions of South America and Southeast Asia. It has figured out the path of globalization according to local conditions and has shown strong strength.

2. Market dynamics

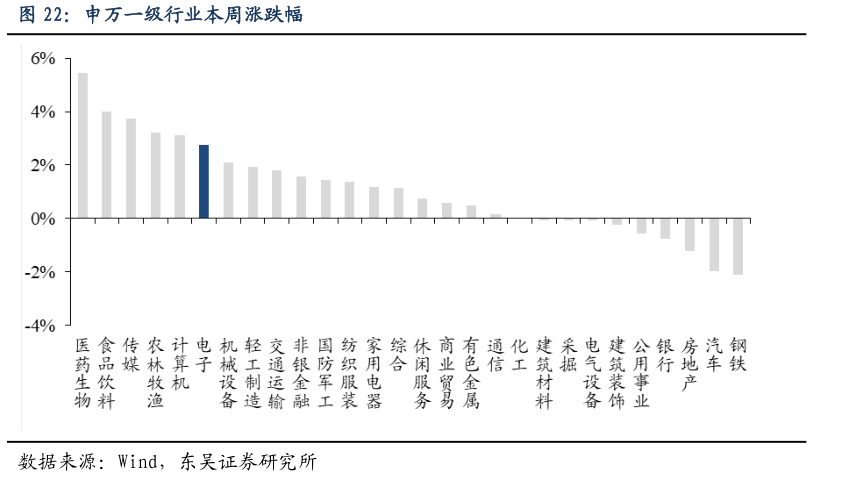

This week the Shanghai Composite Index rose 1.06%, the Shenzhen Component Index rose 2.45%, and the ChiNext Index rose 4.27%. The electronics industry as a whole rose. As of December 4, 2020, the Shenwan Electronics Index was 4,791.95, an increase of 2.79% from the previous weekend. The industry's growth and decline ranked 6/28 among all primary industries.

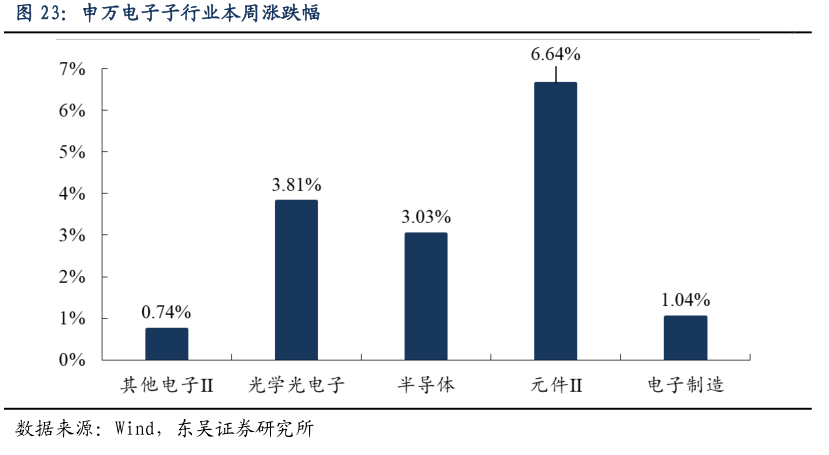

Among the various sub-sectors of Shenwan Electronics this week, the other electronics sector rose 0.74%, the optical optoelectronics sector rose 3.81%, the semiconductor sector rose 3.03%, the component sector rose 6.64%, and the electronics manufacturing sector rose 1.04%.

197 individual stocks in the electronics industry rose this week, with Longli Technology (43.18%), Rainbow Shares (31.86%), and GQY Video (29.20%) among the top gainers; 68 individual stocks fell, with Bestak (-13.23%) and Ju Canopy (-11.02%) and Jingquanhua (-9.62%) were among the top decliners.

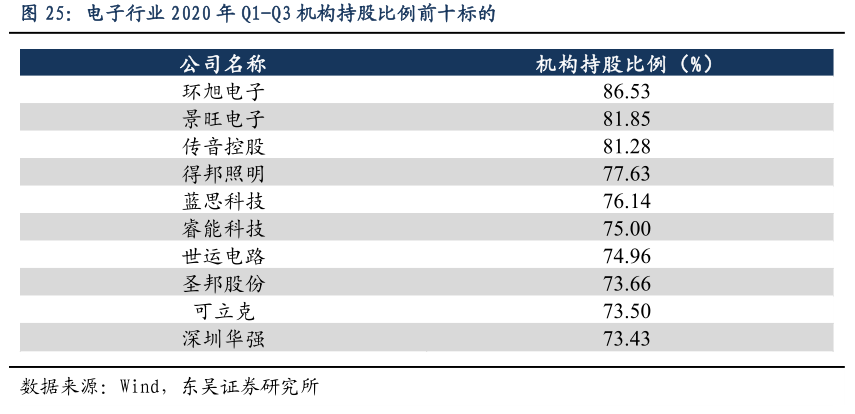

Among the listed companies in the electronics industry in the first three quarters of 2020, USI, Jingwang Electronics, and Transsion Holdings hold the largest shareholding ratios, with 86.53%, 81.85% and 81.28% respectively.

3. Announcement combing

[Pengding Holdings]: On December 5, the company announced that the consolidated operating income for November 2020 was RMB 4,681,200,000, an increase of 48.05% from the consolidated operating income of the same period last year.

[Lens Technology]: On December 1, the company announced that the board of directors reviewed and approved the "Proposal on the Authorization of the Company's Issuance of Stocks to Specific Objects" and the "Proposal on Opening a Special Account for Issuance of Stocks to Specific Objects and Signing a Tripartite Supervision Agreement ".

[Anjie Technology]: On December 1, the company announced that in order to better integrate the resources of the company’s subsidiaries, exert synergy effects, and improve management and operation efficiency, the company’s subsidiary Shixin Technology (Suzhou) Co., Ltd. The 100% equity of Suzhou Gefan Hardware & Plastic Industry Co., Ltd. was transferred to the company’s subsidiary Suzhou Fubao Optoelectronics Co., Ltd. Gefan Hardware is a wholly-owned subsidiary of Shixin Technology. The equity transfer was carried out at a fair price. The price for the transfer of 100% equity of Hardware is 86.56 million yuan. After the above equity transfer is completed, Fubao Optoelectronics will hold 100% of Gefan Hardware, and Gefan Hardware will become a wholly-owned subsidiary of Fubao Optoelectronics.

4. Risk warning

1) Exchange rate fluctuation risk: If the relevant settlement exchange rate fluctuates significantly in the short term, it will have a greater impact on the operating performance of companies related to the industry chain.

2) Macroeconomic fluctuations: With the decline of the macroeconomic boom, consumer market demand will decline accordingly, and the progress of replacing feature phones with smartphones in emerging markets will also be affected, thereby affecting the overall sales of mobile phone products. If the global economy fluctuates sharply in the future, it will have a negative impact on the development of the company's industry.

3) Market development is less than expected: Due to the slowdown of downstream demand, the stable cooperative relationship between related companies and major customers changes or the market development is less than expected, which may adversely affect the company's operating results.

Disclaimer

Soochow Securities Co., Ltd. has been approved by the China Securities Regulatory Commission and has qualified for securities investment consulting business. This research report is only for customers of Soochow Securities Co., Ltd. (hereinafter referred to as "the company"). The company will not treat the recipient as a customer because it receives this report. In any case, the information or opinions expressed in this report do not constitute investment advice to anyone, and the company is not responsible for any loss caused by anyone using the content in this report. Where permitted by law, Soochow Securities and its affiliated institutions may hold and trade securities issued by the companies mentioned in the report, and may also provide investment banking services or other services for these companies. Market risk, the investment need to be cautious. This report is based on the information that analysts of the company believe is reliable and has been disclosed. The company strives but does not guarantee the accuracy and completeness of this information, nor does it guarantee that the opinions or statements in the text will not change in any way. Reports that are inconsistent with the information, opinions and speculations contained in this report may be issued. The copyright of this report belongs to our company. Without written permission, no organization or individual may reproduce, copy and publish in any form. For quotation, publication, and reprinting, the consent of Soochow Securities Research Institute must be obtained, and the source should be indicated as Soochow Securities Research Institute, and this report shall not be quoted, abridged or modified contrary to the original intention.

Soochow Securities Investment Rating Standard:

Company investment rating:

Buying: It is expected that the rise and fall of individual stocks in the next 6 months will be more than 15% relative to the broader market;

Increase in holdings: It is expected that the rise and fall of individual stocks in the next 6 months will be between 5% and 15% relative to the broader market;

Neutral: It is expected that the rise and fall of individual stocks in the next 6 months will be between -5% and 5% relative to the broader market;

Reduction of holdings: It is expected that the rise and fall of individual stocks in the next 6 months will be between -15% and -5% relative to the broader market;

Sell: It is expected that individual stocks will rise or fall below -15% relative to the broader market in the next 6 months.

Industry investment rating:

Increase in holdings: It is expected that in the next 6 months, the industry index will be relatively stronger than the broader market by more than 5%;

Neutral: It is expected that in the next 6 months, the industry index will be -5% and 5% relative to the broader market;

Reduction of holdings: It is expected that the industry index will be relatively weaker than the broader market by more than 5% in the next 6 months.

Soochow Securities Research Institute

No. 5 Xingyang Street, Suzhou Industrial Park

Postal Code: 215021

Fax: (0512) 62938527

Company website: http://www.dwzq.com.cn